Butter vs. Profitwell

While Profitwell attempts to recover failed payments with a bulk, standardized approach, Butter leverages machine-learning based model that processes each payment individually.

The result: More customer and revenue recovered, faster.

Trusted by

-min.svg)

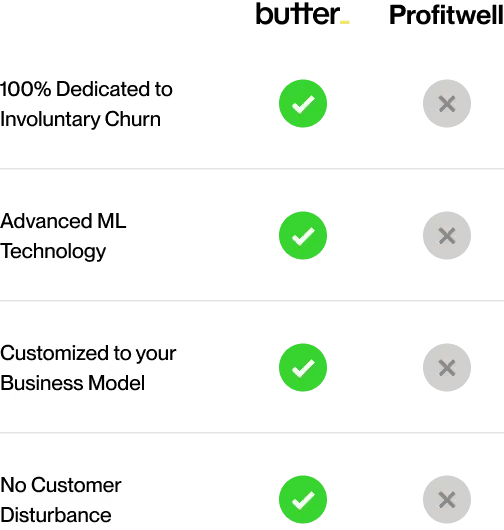

Compare Butter and Profitwell

While Profitwell Retain attempts to boost payment recovery rates by any means necessary - including battering re-tries + client outreach, Butter focuses on maximizing payment recovery through machine learning.

This leads to lower transaction costs and better authorization rates.

How Butter works

We take over recovery the moment a payment fails, taking a per-payment approach

We build ML recovery models customized to your business to maximize performance

We integrate directly with your payment processor and subscription management platform

“Through our partnership with Butter, we have seen significant lift in the customers we recover, with each customer translating to 2x more revenue. When saving a customer from involuntary churn, their LTV also increases because they will have subsequent orders with you. This LTV extension is huge.”

Why choose Butter

We don't make money unless we recover your revenue

- Revenue share contracts

- No implementation fees

- No retainer fees

We optimize for both revenue recovery and your merchant payment health

- Increase transaction authorization rate

- Increase LTV

- Decrease chargebacks

No cookie-cutter strategy: we’re customized to your business

- Subscription value and cadence

- Global and regional customer base

- Digital and physical products

Request a free

Payment Health Analysis

Let Butter's data scientists analyze your current payment health and show you how much revenue we can help you recover

Impact Assessment

Evaluate the financial impact of failed payments on your business

Retry Strategy Evaluation

Assess and improve the effectiveness of your current retry strategy

ROI from Butter

Project the revenue recovery and estimate the ROI from partnering with Butter

TRUSTED BY LEADING B2C, B2B, SAAS, AND E-COMMERCE SUBSCRIPTION COMPANIES

.png)

.png)

-min.svg.png)

-min.svg%20fill.png)